India’s logistics landscape is undergoing a pivotal shift. As the country targets net-zero emissions and improved energy security, electrification of logistics fleets is emerging as a game-changer. However, the

Understanding the ecosystem

The EV logistics ecosystem spans a range of vehicle segments, from electric 3-wheelers, light commercial vehicles (E-LCVs) and electric medium &heavy commercial vehicles (E-M&HCVs) to electric rail solutions (E-rails) for rail logistics. Supporting this transition are battery-as-a-service (BaaS) models, growing financing options, and investments in fleet and charging infrastructure. These segments are critical to India’s clean mobility goals, given that EV penetration in logistics is only 8-10 percent.

How big is the opportunity?

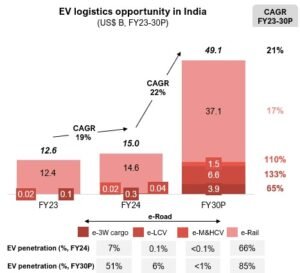

In FY24, India’s EV logistics market stood at ~US$ 15B. By FY30, this is projected to grow 3x to ~US$49B, driven by the electrification of last-mile delivery (3W), urban freight (LCV), and rail logistics.

EV Logistics Opportunity in India

The EV penetration in 3W and E-LCV categories, is expected to reach 51 percent and 6 percent respectively by FY30. However, electrification of medium and heavy CVs will remain limited (<1 percent) due to payload constraints, range limitations, and battery cost economics.

TCO analysis: Are EV fleets economically viable?

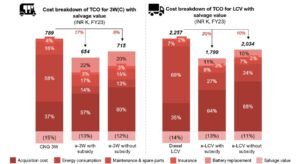

For certain use cases, especially intra-city delivery, the total cost of ownership (TCO) of EVs is already lower than ICE vehicles. E-3Ws and E-LCVs enjoys upto 15-20 percent lower TCO compared to ICE counterparts driven by lower running costs, reduced maintenance, and government incentives. Fleet operators are increasingly adopting models like battery swapping and leasing to overcome upfront capex challenges.

TCO Comparison: ICE vs. electric 3W and LCV

Despite favourable TCO, challenges still persist. EVs have lower payload capacity, limited charginginfrastructure, and higher battery replacement costs. For M&HCVs, electrification remains a long-term goal requiring breakthroughs in battery density and fast-charging technologies.

What will drive scale?

Several enablers are unlocking growth, creating a supportive environment for EV fleet adoption across India:

- Ecosystem maturity: Players like MoEVing and Zyngo are scaling EV fleets across urban centers

- Innovative financing: Leasing, pay-per-use, and battery subscription models are reducing entry barriers

- Digital platforms: Fleet Management Systems (FMS) and Charging Management Systems (CMS) are improving fleet uptime and route optimization

- Policy tailwinds: FAME II incentives, state subsidies, and road tax exemptions

What should stakeholders do?

- OEMs must invest in vehicle platforms optimized for logistics, especially in the E-LCV segment

- Fleet operators should prioritize high-utilization intra-city routes and adopt leasing/BaaS models to minimize upfront risk

- Infra providers need to build dense urban charging networks aligned with high-traffic logistics corridors

- Financiers should create EV-focused underwriting models, leveraging telematics for risk scoring

Conclusion

The economics of EV logistics in India are moving from promise to profitability, especially in the E-3W and E-LCV segments. With policy momentum, ecosystem support, and tech innovation, EV fleets are poised to transform India’s urban freight landscape. However, success will depend on strategic adoption, financing innovation, and focused infrastructure rollout.